Write A Paragraph On Cost And Benefits Of Having Insurance.

Know the costs and benefits of insurance, including financial protection, peace of mind and more. Find out more about the ten key benefits of insurance and why the investment is worthwhile.

Write A Short Paragraph About The Cost And Benefits Of Having Insurance

Insurance is an essential aspect of financial planning, providing protection and security against unforeseen events. Whether it’s health insurance, life insurance, or property insurance, insurance offers numerous benefits that help individuals, families, and businesses overcome financial difficulties. In this article, explore the costs and benefits of insurance and why it’s worth investing in.

Cost of Insurance

The cost of insurance will vary depending on the coverage you want and the level of risk you are willing to take. In general, the higher the coverage, the higher the costs. However, insurance providers offer discounts and other incentives that can reduce insurance costs.

Top

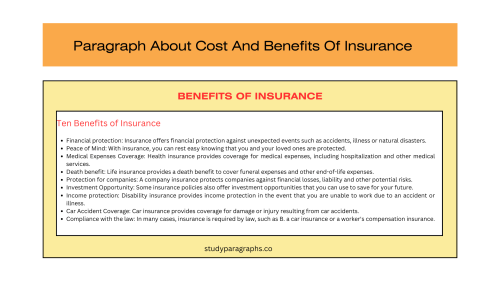

Ten Benefits of Insurance

- Financial protection: Insurance offers financial protection against unexpected events such as accidents, illness or natural disasters.

- Peace of Mind: With insurance, you can rest easy knowing that you and your loved ones are protected.

- Medical Expenses Coverage: Health insurance provides coverage for medical expenses, including hospitalization and other medical services.

- Death benefit: Life insurance provides a death benefit to cover funeral expenses and other end-of-life expenses.

- Protection for companies: A company insurance protects companies against financial losses, liability and other potential risks.

- Investment Opportunity: Some insurance policies also offer investment opportunities that you can use to save for your future.

- Income protection: Disability insurance provides income protection in the event that you are unable to work due to an accident or illness.

- Car Accident Coverage: Car insurance provides coverage for damage or injury resulting from car accidents.

- Compliance with the law: In many cases, insurance is required by law, such as B. a car insurance or a worker’s compensation insurance.

To conclude, insurance offers numerous benefits that can help individuals, families, and businesses overcome financial difficulties. While the cost of insurance may seem high, the benefits it offers make it a worthwhile investment.

FAQ On Cost And Benefits Of An Insurance Plane

What is insurance short note?

Insurance is a form of financial planning that provides protection and peace of mind against unforeseen events. It covers a wide range of areas such as health, life, property, liability, and more, and offers financial support in times of need. The cost of insurance varies based on coverage and risk.

What are the benefits of having insurance?

Insurance provides financial protection against unexpected events such as accidents, illnesses, and natural disasters.

It offers peace of mind and security to individuals, families, and businesses.

Insurance also covers medical expenses, death benefits, property damage, liability, income protection, and more.

What is the cost of insurance?

The cost of insurance varies depending on the type of coverage and the amount of risk you’re willing to take. Generally, the higher the coverage, the higher the cost, but insurance providers offer discounts and incentives that can lower the cost.

Which is always a cost when buying insurance?

The insurance premium.

What must happen in order for an insurance company to make a payout?

Check all that apply.

- The event being insured against must occur.

- The policy must be in force and not expired.

- The policy must cover the event that occurred.

- The claim must be filed and approved.

In what way does a deductible help an insurance company?

A deductible helps to reduce the number of small claims made to the insurance company, which can help to keep premiums lower.

What is the basic purpose of having an insurance plane?

The basic purpose of insurance is to provide the financial protection against unexpected events and losses.

In what circumstance would a property insurance claim be rejected?

If the event that caused the damage is not covered by the policy.

If the policyholder did not take reasonable steps to prevent the damage.

If the damage was caused intentionally by the policyholder.

What is an insurance premium?

An insurance premium is the amount of money paid by the policyholder to the insurance company for coverage.

How can an insurance company make a profit by taking in premiums and making payouts?

The insurance company can make a profit by charging premiums that are higher than the expected payouts and expenses.

Under which circumstance would someone need disability insurance?

Disability insurance may be needed if a person relies on their income to support themselves or their family and would be financially vulnerable if they were unable to work due to a disability.

In what way does a deductible help an insurance company?

A deductible helps to reduce the number of small claims made to the insurance company, which can help to keep premiums lower.

Hello! Welcome to my Blog StudyParagraphs.co. My name is Angelina. I am a college professor. I love reading writing for kids students. This blog is full with valuable knowledge for all class students. Thank you for reading my articles.